AML Course in India

With

100% Placement Assistance & Certification

Online Training | Classroom Training | 45 Days | Real Time Project

Learn the Best AML Course in India with Brolly Academy and get trained by expert mentors. Gain practical knowledge in KYC, transaction monitoring, and fraud detection with real-time projects. Earn your AML certification and build the skills needed to secure jobs in banks, IT, fintech, and International companies.

Table of Contents

ToggleAML Coaching in Hyderabad

Next Batch Details

| Trainer Name | Mr. RAVI RAMA CHANDRAN |

| Trainer Experience | 8+ Real-Time Experience |

| Next Batch Date | 04 – 02- 2026 7:00 PM |

| Training Modes: | Online & Offline Training |

| Course Duration: | 45 Days |

| Call us at: | +91 81868 44555 |

| Email Us at: | brollyacademy@gmail.com |

| Demo Class Details: | ENROLL FOR FREE DEMO CLASS |

Why Brolly Academy is the Best AML/KYC Training Institute in Hyderabad

91.37%

Placement Rate

300+

Google Reviews

4.8

Ratings

20,000+

AML/KYC Professionals Trained

45 Days

AML/KYC Program Duration

Modes

Classroom, online, simulation labs

Fee Range

Affordable

38+

AML Simulation Projects

Why Choose Brolly Academy for AML institute in Hyderabad?

- Multiple real-time AML & KYC projects

- Internship until you secure an AML job

- 100% job-oriented AML training program

- Access to 100+ AML and KYC interview questions

- 3–4 hours of daily lab practice with mentor support

- Practical training on transaction monitoring and reporting

- 100% placement assistance with resume and interview support

- 45 days crash course option available

- One-on-one mentor with project assistance

- Unlimited batch access for 365 days

AML classes in Hyderabad

AML Course Curriculum

- Financial Crime, Definition and stages of money laundering

(placement, layering, integration) - Global impact of money laundering

- Key terms: Predicate offenses, illicit funds, and financial crime

- Types of money laundering risks (e.g., geographic, sectoral, customer)

- Common money laundering typologies (e.g., trade-based, smurfing,

- shell companies)

- Emerging trends (e.g., virtual assets, cybercrime)

- AML in banking, real estate, and precious metals/stones

- AML in Designated Non-Financial Businesses and Professions (DNFBPs)

- Identify and analyse AML risks for a specific industry (e.g., real estate,

banking, or gold trading), during the session and present at the EOS - Sector-specific red flags and compliance challenges

- International AML standards (FATF recommendations & Basel Committee)

- Overview of country regulations laws

- Role of regulatory bodies and reporting requirements

- AML Enforcement and Penalties

- Suspicious Activity Reporting

- Role of international organizations (FATF, INTERPOL, etc.)

- CDD and KYC requirements

- Enhanced Due Diligence (EDD) for high-risk customers

- Key components of an AML compliance program (policies, procedures,

controls) - 1.Role of the Compliance Officer (MLRO)

- 1.Internal controls and risk assessments

- 1.AML Audits and Investigations

- Different types of AML solutions

- 1.Role of technology in AML (e.g., AI, machine learning, blockchain)

AML Training In Hyderabad

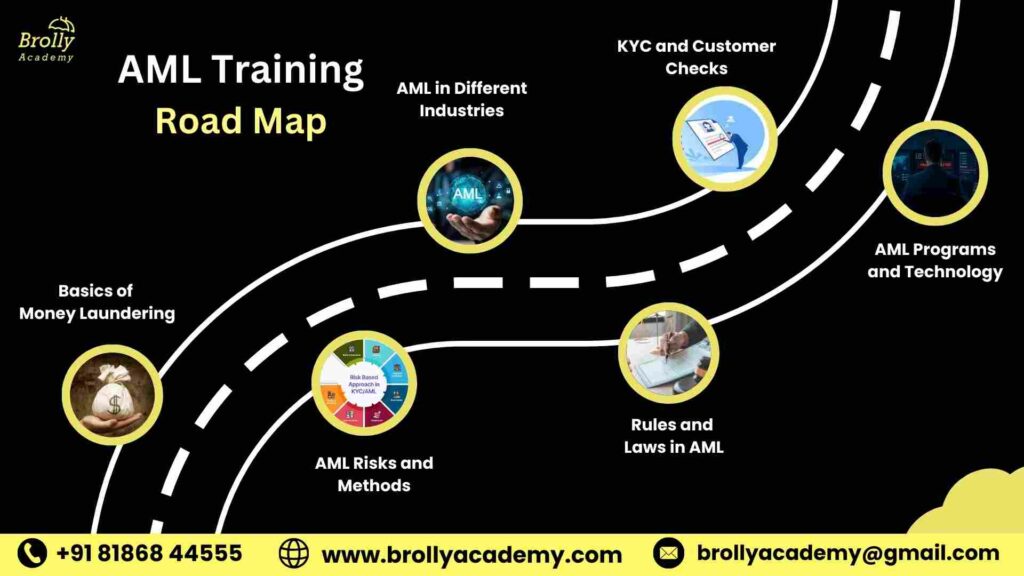

Roadmap

Our AML Course in India is designed to help students and professionals learn Anti Money Laundering (AML) and KYC Rules procedures. The course runs for 1.5 months and covers everything from AML basics, compliance laws, transaction monitoring, fraud detection, and case studies to job-focused interview preparation. Whether you are a beginner or someone seeking AML jobs in India, this program provides placement support and certification guidance, ensuring you are well-prepared for real-time applications.

01

Week 1 – Basics of Money Laundering

- Learn what money laundering is and how it happens in simple steps.

- Understand the stages (placement, layering, integration) with real examples.

- Discuss how financial crimes affect banks and people Internationally.

02

Week 2 – AML Risks and Methods

- Explore different risks in AML, such as customer risk, sector risk, or location risk.

- Study common methods like trade-based laundering, fake companies, and smurfing.

- Talk about new risks like online scams, cybercrime, and digital assets.

03

Week 3 – AML in Different Industries

- See how AML works in banks, real estate, gold trading, and other sectors.

- Spot warning signs in these industries that may point to money laundering.

- Group activity: review a case and discuss what risks are present.

04

Week 4 – Rules and Laws in AML

- Learn about RBI, SEBI, and international bodies like FATF and INTERPOL.

- Understand the role of regulators and how reporting is done.

- Go through what happens when companies don’t follow AML rules.

05

Week 5 – KYC and Customer Checks

- Learn how banks and companies verify customers through KYC.

- Learn how Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) work in easy-to-follow steps.

- Practise checking customer profiles to identify high-risk cases.

06

Week 6 – AML Programs and Technology

- Learn how to create an AML program with simple policies and checks that companies can follow.

- Understand the role of compliance officers and AML audits.

- Explore tools and technologies, like monitoring software, and how they help in AML.

- End with a case study and certification assessment.

What is AML?

- AML stands for Anti-Money Laundering – It’s a set of rules and practices that prevent criminals from hiding illegal money.

- It keeps our financial system safe – Banks and companies use AML to protect people’s money from fraud and scams.

- AML courses in India are popular – Many students and professionals take AML training to start a Career in risk management.

- KYC (Know Your Customer) is part of AML – It’s how banks verify who you are before opening an account or giving a service.

- AML helps fight financial crimes – It stops activities like money laundering, terrorism funding, and fake transactions.

- Companies must follow AML rules – If they don’t, they can get heavy fines or even lose their license.

- AML training with placement is in demand because banks, IT firms, and finance companies need skilled compliance officers.

- Transaction monitoring is a significant part of AML – this involves reviewing customer activity to identify any suspicious activity.

- AML jobs in India are increasing rapidly – Positions like compliance analyst, AML investigator, and KYC officer are highly in demand across banks and financial companies.

- AML certification gives you an edge – A certificate proves your skills and makes it easier to get placed in top companies.

- It’s not just for banks – Today, insurance companies, fintech, and even crypto exchanges need AML and KYC experts.

- AML is about trust – At the end of the day, it builds trust between customers, banks, and the financial system.

Why AML is Used ?

- AML, or Anti Money Laundering, is used to protect the financial system from fraud, scams, and illegal money activities. It makes sure banks, IT firms, and financial companies follow strict rules to keep transactions clean and safe. With the rise of digital payments and international trade, AML has become an essential part of how businesses operate in India and internationally.

- For students and professionals, learning AML through an AML course in India is important because it opens doors to compliance and risk management jobs. AML training covers KYC processes, transaction monitoring, fraud detection, and compliance reporting, which are now in high demand across banks, fintech, and other countries’ companies. That’s why more people are choosing AML certification with placement support to build their careers in this field.

Reason | Explanation |

Prevents financial crimes | AML stops money laundering, fraud, and terrorist financing by tracking suspicious transactions. |

Builds customer trust | KYC AML training ensures banks verify customer details, keeping the system transparent and safe. |

Protects companies from penalties | Without AML compliance, banks and firms can face heavy fines or lose their license. |

Helps detect unusual activity | Transaction monitoring courses teach how to spot red flags and suspicious patterns in customer behavior. |

Opens career opportunities | AML certification in India is widely recognized and helps students get jobs like AML analyst, investigator, or KYC officer. |

Supports international rules | AML laws in India follow global rules, so professionals can work in both local and international companies. |

Ensures business growth | By reducing risks, AML allows banks, fintech, and IT companies to grow safely and responsibly. |

Where AML is Used

AML, or Anti Money Laundering, is used anywhere money moves, especially in banks, financial companies, IT firms, and even new industries like fintech and crypto. It makes sure money is clean, customers are verified, and suspicious activities are tracked. Learning this through an AML course in India helps students and professionals build careers in Risk management, as AML jobs are growing fast in India.

- Banks and financial institutions: AML certification helps banks monitor large transactions and follow RBI and SEBI compliance rules.

- Insurance companies: KYC AML training is used to check customer identity and prevent fraud in insurance claims.

- Fintech and digital payments: With online money transfers rising, AML is used to track suspicious activities and prevent scams.

- IT and outsourcing companies: AML course with placement prepares professionals to work on compliance projects for International clients.

- Crypto and blockchain platforms: AML helps exchanges verify users and report risky transactions to keep the system safe.

- Government and regulators: AML frameworks are used to create laws and guidelines that companies must follow.

- E-commerce and trading platforms: Transaction monitoring is applied to stop fake accounts, money laundering, and fraud.

- Career development: AML certification in India is widely accepted and helps learners get roles like compliance analyst, AML investigator, and KYC officer.

AML Course In India

Benefits of the Course

- Joining an AML course in India is not just about studying rules. It’s about building a career in one of the fastest-growing fields today. Banks, fintech companies, and IT firms are seeking individuals who possess expertise in KYC, transaction monitoring, fraud detection, and AML reporting.

- With an AML certification that also offers placement support, you’ll gain practical skills and get the right guidance to start your career.

- This course is made for both beginners and working professionals who want to enter the growing field of AML jobs in India.

- Many companies in banking, insurance, fintech, and even crypto are looking for trained AML professionals who can protect money and follow compliance rules. That’s why our AML course with job assistance can give you the right skills and support to move your career forward.

1. Career Growth

An AML course in India adds value to your resume and improves your chances of getting compliance and risk management jobs.

2. International Recognition

AML certification is accepted internationally, preparing you for both local AML jobs in India and international opportunities.

3. Better Salary Potential

Trained AML professionals often get higher salaries compared to non-certified candidates in banking and IT firms.

4. Built Confidence

With KYC AML training and transaction monitoring practice, you’ll gain the confidence to handle real compliance tasks.

5. Placement Assistance

Our AML certification with placement support helps you prepare for interviews, build resumes, and connect with hiring companies.

6. Lots of Career Options

AML skills are useful across industries like banking, insurance, fintech, IT, and even crypto exchanges.

7. Future Ready Skills

With an updated AML syllabus covering RBI, SEBI, and International laws, you’ll always stay ahead of compliance requirements.

8. Networking Opportunities

AML training connects you with trainers, peers, and industry professionals for better career growth.

9. Long-Term Value

An AML certification in India benefits you for years, proving your expertise to employers and opening new career paths.

Thinking of an AML Coaching in Hyderabad? (India)

- Traditional Training

- Basic theory classes only

- Limited focus on jobs

- Outdated syllabus

- No personal guidance from trainers.

- One-way teaching

- No career support

- Outdated strategies with a low success rate.

- Only the classroom mode

- General compliance knowledge

- No exposure to tools

- Limited scope

- One-time classes

- Brolly Academy Training

- Real-time AML projects with KYC and transaction monitoring practice

- Job assistance with resume prep and interview guidance

- Updated AML syllabus covering RBI, SEBI, and International AML laws

- One-on-one mentor support & doubt clearing.

- Interactive coaching with case studies and compliance tools

- Flexible learning – online AML training, offline, and weekend batches

- Special focus on AML & KYC training for financial institutions and IT companies

- Hands-on transaction monitoring course with real software practice

- Flexible learning: online & offline options.

- Skills to get AML jobs in India and abroad across banking, fintech, and insurance

- Unlimited batch access for 365 days for revisions and practice

Best AML training Institute in Hyderabad

Meet Your AML Trainer

INSTRUCTOR

Mr. Ravi Rama Chandran

AML & Compliance Expert, Lead Instructor, Corporate Mentor

8+ Years Experience

About the tutor:

Mr. Ravi Rama Chandran is a skilled professional with over 8 years of experience in Anti-Money Laundering (AML), KYC, and compliance training. He has worked with leading financial institutions and IT companies, guiding teams to handle transaction monitoring, customer due diligence, fraud detection, and International compliance practices.

He is well-regarded for mentoring and training students, helping them build strong careers in the AML and KYC domains. His teaching style focuses on practical learning, real-time case studies, and job-oriented training that prepares learners for AML jobs in India and abroad.

We believe and proudly state that he is one of the most trusted AML trainers in Hyderabad, known for his commitment to student success and career growth.

AML Course In India

Skills Developed after the course

- You will understand how AML laws and the following rules work in India and globally, including RBI and SEBI guidelines, so you can confidently apply them in real jobs.

- You’ll gain practical skills in KYC and customer verification, learning how banks and companies confirm identity and prevent fake accounts.

- You will develop expertise in transaction monitoring, which helps you track money movement and identify unusual or suspicious activities.

- You’ll learn the step-by-step process of fraud detection and reporting, giving you the ability to prepare compliance reports that companies trust.

- You will build the habit of Paperwork and record-keeping, a key requirement for audits and compliance checks in banks and financial institutions.

- By working on real AML case studies, you’ll strengthen your problem-solving skills and learn how to handle compliance challenges effectively.

- You will gain hands-on experience with AML certification training, which prepares you for AML jobs in India and even global Rule-following roles.

- You’ll improve your interview readiness with access to 100+ AML and KYC interview questions, making you more confident in job placements.

- You will have career flexibility, as AML skills are in demand not just in banking but also in IT, fintech, insurance, and crypto companies.

- You’ll be future-ready for AML jobs with a solid foundation that employers look for, giving you the chance to work both in India and abroad.

AML Capstone Projects Covered in the Course

AML Course Capstone Projects Covered

1. KYC Verification Case Study

Work on real scenarios where you check customer details and identify fake or risky profiles.

2. Transaction Monitoring Project

Learn how to track money movement and detect suspicious activities in banking systems.

3. Fraud Detection Simulation

Practice spotting unusual patterns that point to fraud and prepare simple reports.

4. Compliance Reporting Exercise

Create reports for companies that show how rules and regulations are being followed.

5. Risk Assessment Project

Understand how to measure customer risk levels and classify them into low, medium, or high categories.

6. End-to-End AML Case Study

Put all your skills together by solving a full AML problem from KYC checks to reporting.

AML course in Hyderabad fees

AML Training Fee & Offerings

Video Recording

Rs 13,999 6,999

- Lifetime video access

- Basic to advanced level training

- 40+ recorded classes

- Capstone project

- Resume & interview support

- 100% placement assistance

- WhatsApp group access

Class Room Training

Rs 23,999 19,999

- 45 days structured training

- One-on-one mentorship

- Weekly mock interviews

- Resume & interview guidance

- Soft skills training

- Dedicated placement officer

- Commute support (offline batches)

- WhatsApp support + group access

Online Course

Rs 19,999 14,999

- Live interactive classes (flexible timings)

- 45 days duration

- Daily recorded sessions for revision

- Project environment from Day 1 until placement

- Weekly mock interviews

- Doubt-clearing sessions

- 50+ sample resumes access

- WhatsApp group access

AML institute in Hyderabad

Placement Program

At Brolly Academy, we truly believe that learning AML should also lead to building your career. That’s why we offer placement assistance.

- You’ll get help to build a strong resume that shows off your AML certification and Ability for Risk Analyst roles.

- We offer mock interviews so you can practise answering common AML, KYC, and Standards questions without feeling nervous.

- Our placement team connects you with companies in banking, fintech, IT firms, insurance, and other fields that need AML-trained professionals.

- You get support shaping your profile and preparing for AML jobs in India, which are growing fast.

- Resume prep, interview tips, and real-time KYC AML training experience make you job-ready, not just course-ready.

- You’ll feel confident stepping into your first AML role, whether it’s as a Risk Analyst, AML investigator, or KYC officer.

Resume Building

Placement Training

Interview Questions

Realtime Live Projects

Get Offer Letter

Scheduling Interviews

Mock Interviews

Personality Development

- Resume Building: We help you design a strong resume that highlights your AML certification, KYC AML training, transaction monitoring projects, and fraud detection skills, making you stand out for AML jobs in India.

- Placement Training: Learn how the AML job market in India works and what companies in banking, IT, insurance, and fintech expect from professionals.

- Internships Under Experts: Work on live AML course projects in India, including real KYC checks and risk analytics reporting, guided by experienced trainers.

- Real-time Live Projects: Get practical exposure with transaction monitoring course modules, risk assessment, and compliance reporting, preparing you for day-to-day AML roles.

- Personality Development: Improve your confidence, sharpen communication skills, and practise mock interviews focused on AML certification with placement support.

- Scheduling Interviews: Connect with banks, IT firms, fintech companies, and global organizations that are actively hiring for AML jobs in India.

- Get an Offer Letter: With the right skills and placement assistance, you’ll be ready to start your career in AML and KYC Rules & Laws, and move towards long-term growth.

What Our Students Say About AML Training in Hyderabad

Testimonials

AML Coaching in India

Student Community

Learning Together

Work with other students on AML case studies, share ideas, and solve real Law-related problems as a team.

Access to Tools & Materials

Get study materials, practice projects, and Training on AML tools like transaction monitoring and KYC systems.

Networking with Experts

Connect with AML trainers, industry mentors, and hiring partners through community sessions.

Guidance from Professionals

Learn directly from AML professionals who handle real AML and KYC projects in banks and companies.

Career Growth Support

Get job assistance, resume help, and interview practice to prepare for AML jobs in India and abroad.

AML Classes in Hyderabad

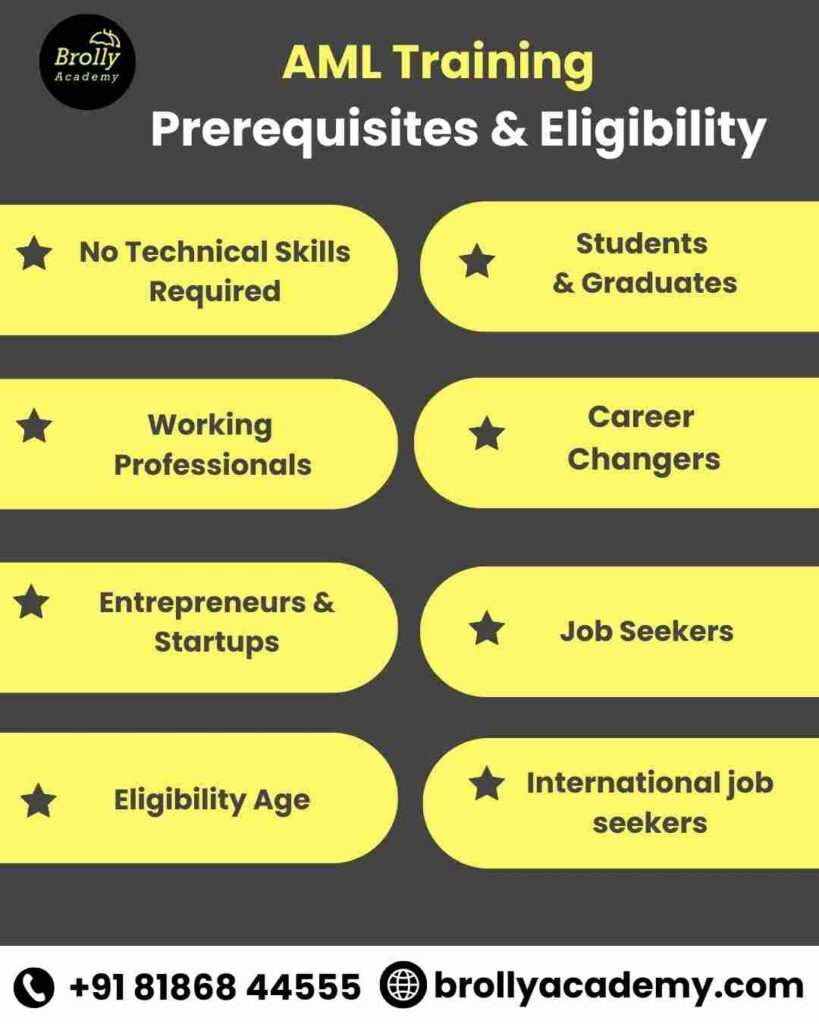

Pre-requisites & Eligibility

The AML course in India is open to anyone who wants to build a career in KYC, AML, and Risk management jobs. You don’t need advanced knowledge or a finance background to start. Basic computer skills, an interest in learning how financial systems work, and a willingness to practise are enough. This course is designed for beginners, students, working professionals, and anyone who wants to step into the growing demand for AML jobs in India with the help of AML certification and placement support.

- No Technical Skills Required – You don’t need coding or IT knowledge to join. Basic computer skills and an interest in learning the AML course in India are enough.

- Students & Graduates – Whether you’re still studying or just completed your degree, this AML certification is open to learners from all platforms.

- Working Professionals – Employees from banking, IT, finance, or insurance can upgrade their skills with KYC AML training and transaction monitoring practice.

- Career Changers – If you want to switch from another field, this course helps you enter the fast-growing industry of AML jobs in India.

- Entrepreneurs & Startups – Business owners and founders can understand AML rules and Legal basics to manage financial safety in their companies.

- Job Seekers – Ideal for freshers who want AML certification with placement assistance and real project experience.

- Eligibility Age – Open to learners aged 18 years and above with an interest in AML, KYC, and compliance career opportunities.

- International job seekers – Since AML skills are needed for every company. So this course prepares you for AML jobs in India as well as international opportunities.

Who Should Learn AML Training in India?

- Students & Fresh Graduates – If you are looking to start your career in finance, IT, or banking, an AML course in India gives you the skills to land your first job.

- Job Seekers – Anyone searching for AML jobs in India can benefit from this training, as it teaches KYC, fraud detection, and transaction monitoring.

- Working Professionals – Employees from banking, fintech, or insurance who want to move into policy and control or risk management can join this AML certification program.

- Career Changers – People from different fields who want to enter the fast-growing sector of AML and KYC training can switch with this course.

- Entrepreneurs & Startups – Business owners can learn AML certification basics to make sure their company follows financial regulations and avoids risks.

- International career seekers – Anyone planning to work abroad in banking or financial services can take this course, as AML certification is recognized internationally.

- IT & Data Professionals – Those who work with data, reporting, or system monitoring can enhance their profiles with transaction monitoring and AML training.

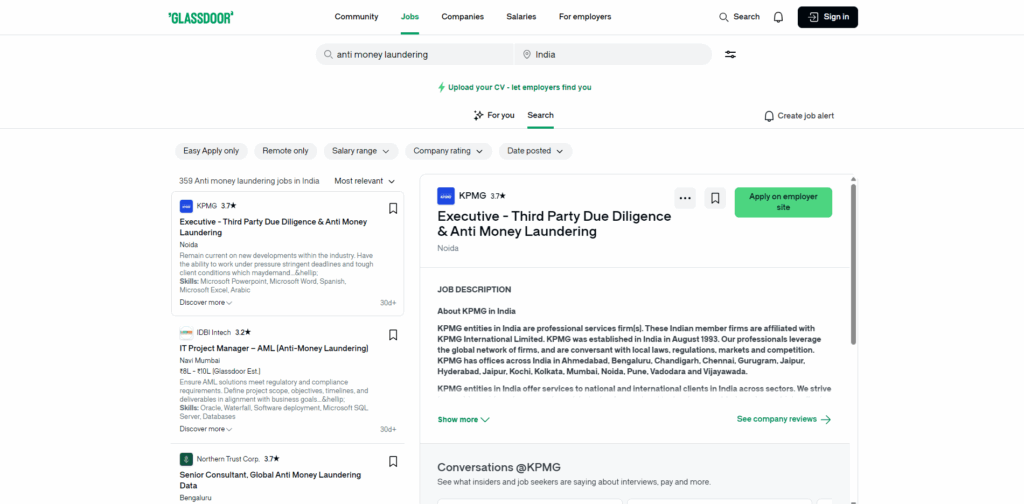

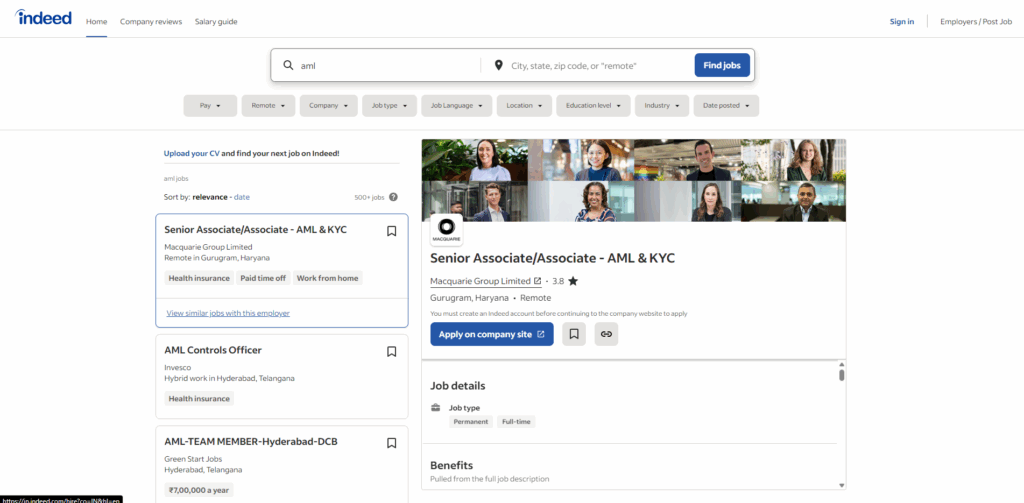

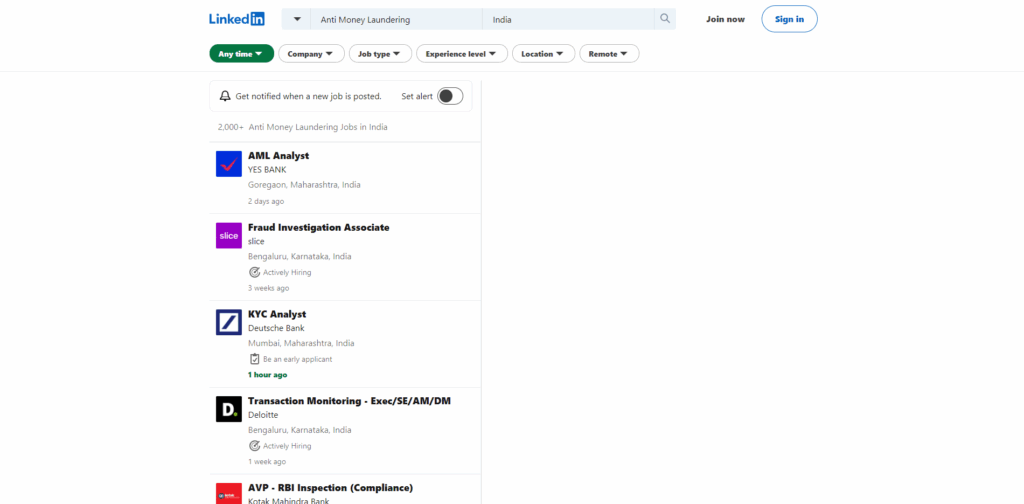

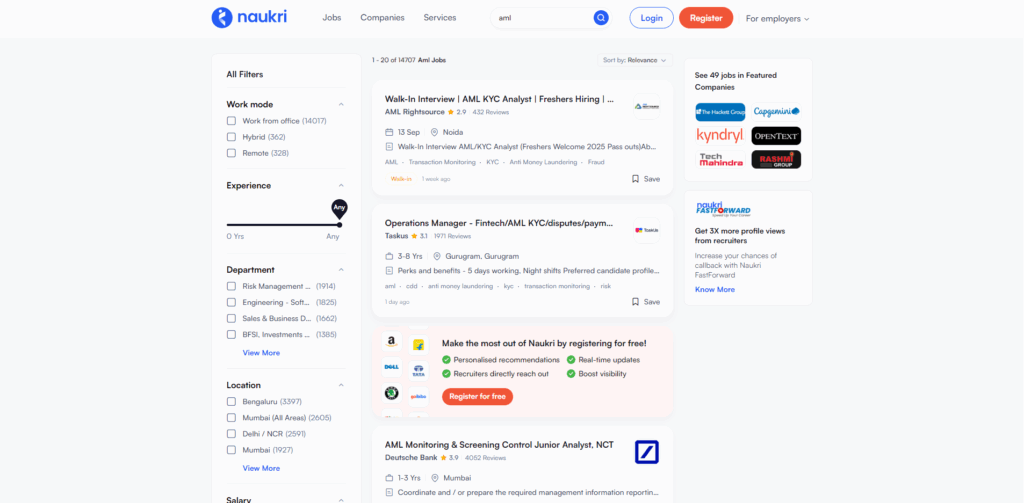

AML jobs in Hyderabad for Freshers

Career Opportunities

- AML / KYC Analyst – Start your career by checking customer details, spotting fraud, and applying KYC rules after your AML certification.

- Transaction Monitoring Analyst – Track and review money transfers daily to catch any unusual or risky activities with skills from transaction monitoring training.

- Compliance Officer / Analyst – Work with banks or IT firms to ensure they follow RBI, SEBI, and global AML rules and regulations.

- Senior AML Investigator – Handle high-risk cases, investigate complex fraud, and prepare detailed reports for supervisors.

- AML Team Lead / Assistant Manager – Lead a team of analysts, manage daily AML jobs in India, and make sure policy procedures run smoothly.

- Compliance Manager (Financial Services) – Take charge of AML programs, audits, and reporting for banks, fintech, and International companies.

Over 24000+ job openings available for AML in India for freshers

AML Salary in Hyderabad – Latest Updates 2026

Role | Basic (0–2 yrs) | Advanced (3–6 yrs) | Professional (7+ yrs) |

AML / KYC Analyst | ₹3.2–4.5 LPA | ₹5–8 LPA | ₹9–14 LPA |

Transaction Monitoring Analyst | ₹3.8–5.0 LPA | ₹5.5–8.5 LPA | ₹9–12 LPA |

Compliance Officer / Analyst | ₹5.5–8.0 LPA | ₹8.5–12 LPA | ₹13–20 LPA |

Senior AML Investigator | — | ₹9–14 LPA | ₹15–24 LPA |

AML Team Lead / Assistant Manager | — | ₹10–15 LPA | ₹16–26 LPA |

Compliance Manager (Financial Services) | — | ₹14–22 LPA | ₹22–35 LPA |

Best Digital Marketing training institute in Hyderabad with placement

Our Achievements

Completed 36+ Batches

8+ Years of experience

682+ Students Placed

Pioneer in the Industry

AML Certification Course in India

At Brolly Academy, when you finish the AML course, you’ll get a certification that proves you are trained and job-ready. This is not just a paper. Our certificate shows that you worked on real case studies, KYC checks, fraud detection tasks, and compliance reports during training. It gives you confidence while applying for jobs, and employers see it as proof of your skills. Along with this, we support you with placement assistance, interview practice, and career guidance, making it easier for you to start your journey in the growing field of AML jobs in India.

AML Certifications You Will Receive

An AML certification is like proof that you have learned how to stop money crimes and keep financial systems safe. It shows that you understand the basics of KYC, transaction monitoring, and fraud detection, and you can follow the rules set by RBI, SEBI, and global regulators. Having this certificate makes your resume stronger and gives you better chances of getting jobs in banks, IT companies, fintech, insurance, and even crypto. Simply put, it opens doors to more AML jobs in India and helps you stand out from other candidates.

- AML Course Completion Certification

- AML Course Internship Certification

What is the Cost of AML Certification in India?

Certification | Provider | Approx. Fee (INR) |

IIBF – Certificate in AML & KYC | Indian Institute of Banking & Finance | ₹1,600 (Non-members) / ₹1,100 (Members) |

NISM – Certified AML Manager (CALM) | National Institute of Securities Markets | ₹9,000 + taxes |

India Forensic – CAME | India Forensic | ₹30,000 |

ICA – AML Certification | International Compliance Association | ~₹75,000 (₹60,200 course + ₹11,610 membership) |

ACAMS – CAMS Certification | Association of Certified AML Specialists | ₹80,000–₹1,50,000 (including exam, materials) |

AML Investigator Certificate | RegTech Times Academy | ₹55,000 (US$650 ≈ ₹55k) |

Market trends of AML course

Market Trends

- Growing Demand for AML Jobs in India : Banks, IT firms, fintech, and insurance companies are hiring more AML-certified professionals to fight financial crimes.

- Growing Demand for AML Jobs in India : Banks, IT firms, fintech, and insurance companies are hiring more AML-certified professionals to fight financial crimes.

- KYC and Transaction Monitoring as Core Skills : Skills from KYC AML training and transaction monitoring courses are now seen as essential for compliance careers.

- Better Salaries for Certified Professionals : Salaries for AML analysts and investigators are increasing year by year, creating a strong career path.

- Job-ready AML Courses in India : Companies often choose candidates who have completed an AML course with placement assistance, as they are job-ready.

- International Career Opportunities with AML Training : AML certification is recognized and It will help students apply for AML jobs in India and abroad.

- New Openings in Fintech and Crypto : Digital payments, fintech startups, and crypto companies are adding more AML and KYC roles, creating fresh opportunities.

AML Course in India

FAQS

1. What is an AML course in India?

An AML course in India teaches you how to prevent money laundering by using KYC, transaction monitoring, and fraud detection skills.

2. Why is AML training important?

AML training is important because it helps banks and companies stop illegal money movement and keep the financial system safe.

3. Who can join the AML course in India?

Students, fresh graduates, job seekers, and working professionals who want to start a career in AML or KYC can join.

4. Do I need a finance background for this course?

No, you don’t need a finance degree. Basic computer skills and an interest in learning are enough.

5. What is covered in KYC AML training?

You’ll learn how to verify customer details, check documents, and prevent fraud by applying KYC rules.

6. Does the AML course include transaction monitoring?

Yes, the AML course includes a transaction monitoring course module to teach how to spot suspicious activities.

7. How long is the AML course in India?

The AML course usually takes around 1.5 months to complete, and that’s the same at Brolly Academy too.

8. What certification will I get after this course?

You’ll receive an AML certification that proves your knowledge of KYC, fraud detection, and compliance skills.

9. Is the AML certification valid worldwide?

Yes, an AML certification is accepted by companies in India as well as abroad, making it useful for both local and international careers.

10. What are the job opportunities after the AML course in India?

You can work as an AML analyst, KYC analyst, transaction monitoring specialist, compliance officer, or AML investigator.

11. What salary can I expect after completing the AML course?

Freshers can expect around ₹3–5 LPA, while experienced professionals earn ₹8–20 LPA depending on the role.

12. Can I expect career support from Brolly Academy once the AML course is completed?

Yes, Brolly Academy offers placement assistance with resume help, interview practice, and company connections.

13. Are there live projects included in the AML training?

Yes, you’ll work on real projects like fraud detection, KYC checks, and compliance reporting.

14. Can working professionals take this course?

Yes, many working professionals join to switch careers into AML jobs in India.

15. Do fintech and crypto companies hire AML professionals?

Yes, fintech startups and crypto firms are hiring AML-certified experts for compliance roles.

16. What role does Customer Due Diligence (CDD) have in AML training?

CDD is the process of checking customer details before allowing financial transactions.

17. What is Enhanced Due Diligence (EDD)?

EDD is an advanced check for high-risk customers to prevent money laundering.

18. Will I get KYC AML interview questions for practice?

Yes, learners at Brolly Academy receive more than 100 AML and KYC interview questions to prepare for placements.

19. Do I need coding skills for the AML course?

No, you don’t need coding or IT skills. Basic computer knowledge is enough.

20. Can I take this AML course online?

Yes, the AML course in India is available in both online and offline modes.

21. What are the advantages of doing an AML certification in India?

It helps you get AML jobs, proves your skills, and increases your salary potential.

22. Is there a placement guarantee with AML courses?

Institutes like Brolly Academy provide job assistance, not guarantees, to help you secure AML jobs in India.

23. Which companies hire AML-certified professionals?

Top companies like JPMorgan, HSBC, Deloitte, Infosys, and KPMG hire AML experts.

24. What is transaction monitoring in AML training?

It means keeping an eye on money transfers to find anything suspicious or unusual.

25. Is AML certification useful outside banking?

Yes, an AML certification can help you find jobs not only in banking but also in IT, fintech, insurance, and even crypto companies.

26. Can freshers apply for AML jobs in India?

Yes, we conduct customized corporate training programs for companies and teams.

27. What makes Brolly Academy the right choice for AML training in India?

- What makes Brolly Academy the right choice for AML training in India?

28. How is the demand for AML jobs growing in India?

The demand is increasing every year as regulations get stricter and companies need more AML experts.

29. Does the AML course cover international AML laws?

Yes, the course not only covers RBI and SEBI guidelines but also includes international AML laws.

30. Is AML training good for global careers?

Yes, AML certification opens doors to global career opportunities in banking, IT, and financial services.

Other Relevant Courses

Got more questions?

Talk to Our Team Directly

Contact us and our academic councellor will get in touch with you shortly.